2022 Was Not a Record-Breaking Year for Drone Investments—But the Drone Industry Is Still Strong

BY Zacc Dukowitz

19 April 2023From 2017 to 2021, investments in the drone industry grew every single year, with each year’s numbers topping those of the previous year.

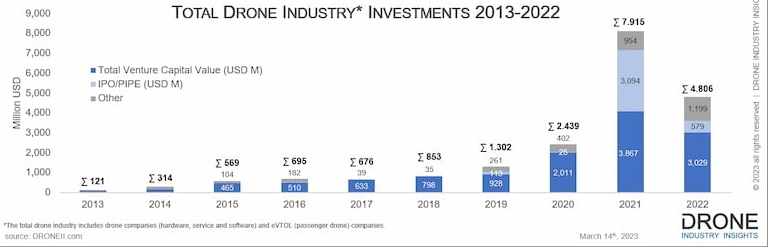

2021 was an incredible year for drone investments, with a total of $7 billion raised globally across 199 investment deals. That number is even more impressive when you compare it to the year before, when only $2.4 billion was raised, making the amount for 2021 almost triple that of the previous year despite the continuing economic impact of COVID-19.

But a recent report from Drone Industry Insights shows that this trend of record-breaking investment years has finally come to an end.

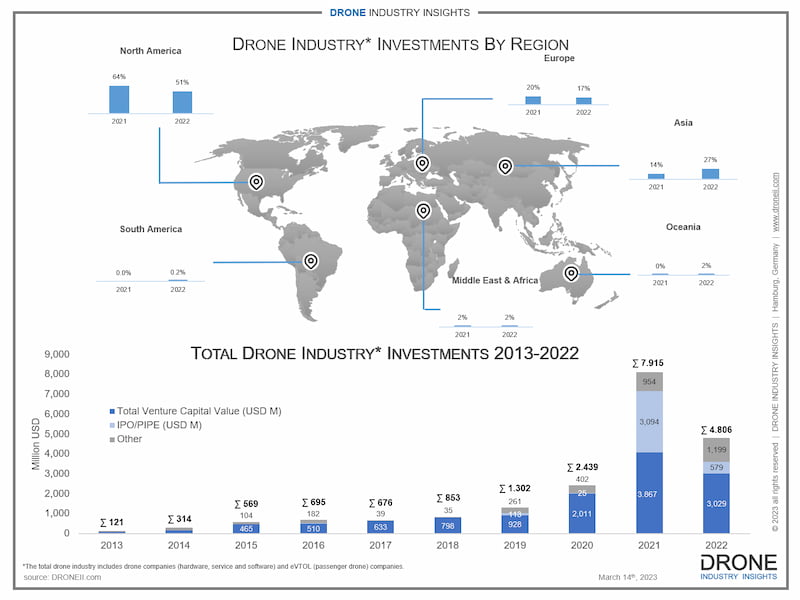

Credit: DroneII

In 2022, for the first time in five years, the amount invested in the drone industry was lower than the amount invested the year before, both in the U.S. and throughout the world.

And the dip was significant. From 2021 to 2022, instead of growing, investments in the drone industry dropped by 39% overall.

2022 Was Still a Very Strong Year for Drone Investments

39% is a big drop.

But this drop doesn’t mean that 2022 was a bad year for the drone industry, or that there weren’t any investments.

2022 was actually a very strong year for the drone industry, bringing a total of $4.8 billion invested throughout the world across 179 investments.

That amount is double the 2020 investment. It’s also more than was invested in 2018, 2019, and 2020 combined.

Here’s a look at the totals per year going back to 2013:

Stock Investments Grew Despite the Overall Investment Dip

Something that’s worth noting is the composition of the investments.

In 2022, investments were made up of:

- 63% VC (Venture Capital)—$3.029 billion

- 25% IPO/PIPE (Initial Public Offering/Private Investment in Public Equity)—$1.199 billion

- 12% Other—$579 million

In 2021, IPO and PIPE investments were smaller than they were in 2022, making up just 12% of the overall investments made.

At a high level, IPO and PIPE investments represent market maturity.

Both have to do with the stock market—when companies hit the stock market, they make an IPO, and this is an opportunity for people to invest by buying stock in the company. PIPE represents investments made in the form of lump purchases of stock by private investors.

If you look at the timeline above, IPO and PIPE were basically non-existent way back in 2013. Only in 2019 do we see these numbers start to grow. And in 2022, they are the biggest they’ve been yet—a key data point when considering the overall dip in growth.

Despite that dip, the fact that IPO and PIPE investments grew year over year could signal that the drone industry is entering a new phase of maturity. While huge cash infusions of venture capital may be dropping off, drone companies are starting to be real players, with the profits to show for it—and these are the kinds of companies that people invest in through stock purchases.

Partnerships Also Grew

Another data point that highlights the strength of the drone industry is that, despite the overall dip in investments, Mergers & Acquisitions (companies buying or merging with other companies) and partnerships stayed strong.

Overall, there were 270 partnerships in 2022 and only 193 in 2021. Also, there were 40 deals made in 2022 and 47 deals made in 2021, for a drop of just 14%.

That’s not a very steep drop, especially in light of the overall dip of 39% of investments.

Notably, many of the partnerships made in 2022 were between drone companies and companies that made other, non-drone products.

The majority of these partnerships (74%) were between drone companies and non-drone companies, which once again is a strong sign of how drone technology can support work activities and operations in many other industries.

– Drone Industry Insights

Where Were Investments Made?

North America was the number one region where drone investments were made last year, as it has been in the past. But its lead over other regions was less significant—in 2021, North America had 64% of global drone investments, while in 2022 the amount was 51%.

Another notable change is that Asia overtook Europe from 2021 to 2022, becoming the second region on the list with a jump from 14% to 27%, while Europe fell from 20% to 17%.

Why Did Investments Drop from 2021 to 2022?

Following the thinking above, it could be that investments dipped due to market maturity—the drone industry is starting a new phase, exiting a stage of aggressive investment and entering one of actual profitability, in which you would expect investments to stabilize somewhat.

But there are also some key events that should be considered when looking at the change from 2021 to 2022:

- War in Ukraine. The total number of drone investments started to decrease in May 2022, a few months after the war started. This was right around the time reporting from the war began highlighting the use of consumer drones in the war effort.

- Rising inflation. Inflation related to the economic fallout from the COVID-19 pandemic continued to be a pain point throughout 2022.

It will be hard to know if speculation about maturity is true until we see the numbers from 2023.

Either way, the big takeaway from the report is that the drone industry as a whole is in a strong position, and companies are still making significant investments in it.