The Top Drone Model Insured by Drone Pilots and Other Trends from SkyWatch

BY Zacc Dukowitz

13 April 2022SkyWatch is one of the first companies ever to offer insurance specifically tailored for the needs of drone pilots.

The company launched back in 2018, just two years after the FAA issued its Part 107 rules detailing the requirements for commercial drone operations. Since then it has garnered tens of thousands of customers in the drone industry.

We recently got a special first look at data SkyWatch has collected on how drone pilots use its services, including trends that reveal the changes in drone insurance over time and which models drone pilots are insuring the most.

When looking at this data, it’s important to note that the majority of those purchasing drone insurance are probably commercial drone pilots. This means that the trends the data reveal won’t necessarily apply for recreational flyers, though they may still inform overall movements in the industry.

Let’s dive into the data.

What Drone Models Are Drone Pilots Insuring?

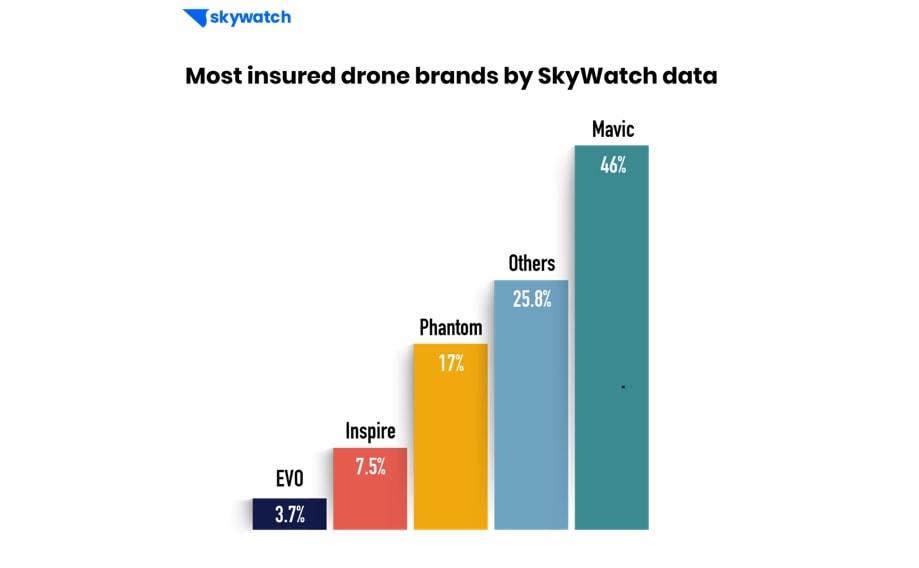

The first thing we notice when we look at Skywatch’s data on drone model coverage is that the DJI Mavic series has a huge chunk of the pie, representing 46% of the drones that pilots have insured with SkyWatch.

DJI also dominates the 2nd and 3rd positions in the list of top insured drone models, with its Phantom and Inspire series respectively holding 17% and 7.5% of insured drone models. Overall, DJI accounts for 70.5% of all the drones insured with SkyWatch.

The majority of the remainder goes to the Others category (25.8%), which covers drone models that took too small a piece of the overall pie to get their own individual percentages.

The only position on the list held by a non-DJI drone is the Autel EVO, with 3.7%. With the release of the EVO Nano and the EVO Lite this year, Autel may make even more gains in 2022 (though we wouldn’t expect DJI to lose too much ground).

This data corresponds fairly closely with what we see overall in the U.S. when it comes to market share, with DJI dominating the overall commercial and consumer drone market.

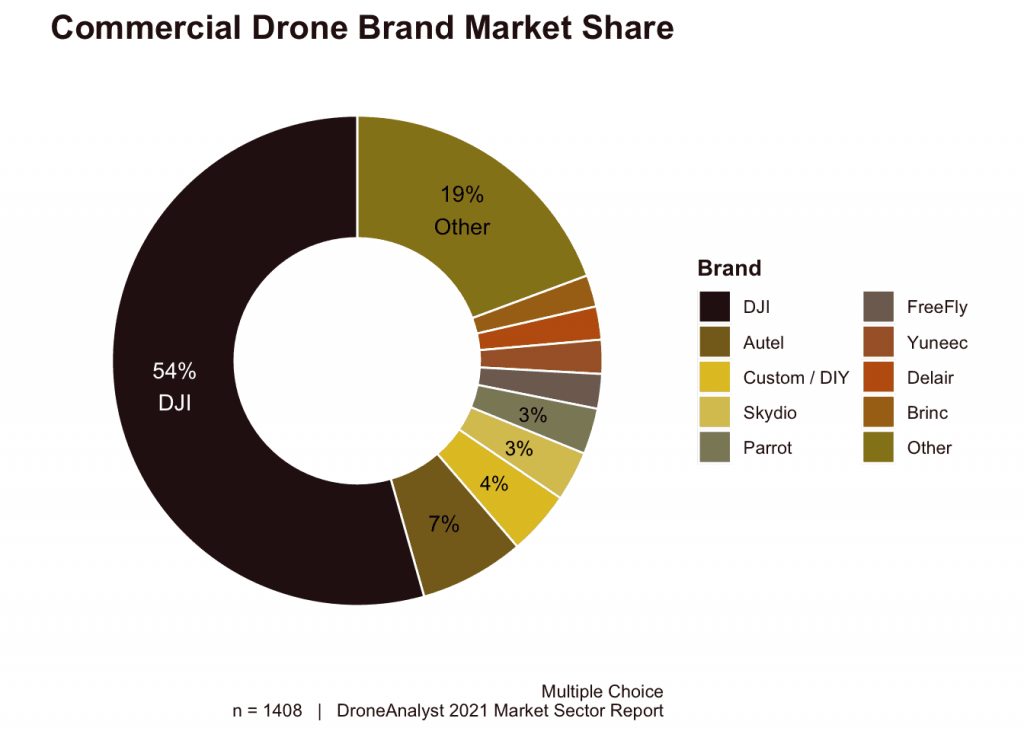

It is interesting to note that SkyWatch’s numbers correspond almost 1:1 with DroneAnalyst’s data from 2020. That year, DroneAnalyst found that DJI held 69% of the commercial drone market.

But in 2021, DJI’s commercial market share dropped to 54%, with Autel second in line at 7%.

Credit: DroneAnalyst

It could be that there is a lag between new drones purchased and drones insured, which could account for this gap—that is, SkyWatch’s data may include a majority of somewhat older drone models (models from 2020 or earlier), while DroneAnalyst’s data may contain mostly new drones (models from 2021).

It will be interesting to see if next year’s data from SkyWatch shows a dip in DJI dominance that corresponds with DroneAnalyst’s 2021 data, which would validate this hypothesis.

Drone Pilots Are Valuing Their Drones More and More

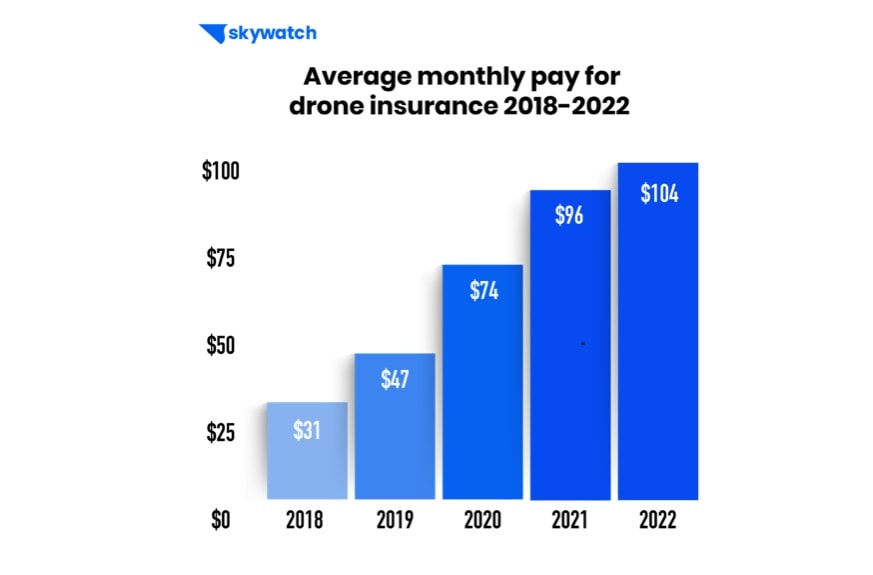

From 2018 to 2022, drone pilots have chosen to pay more for drone insurance every single year, from an average of $31 a month in 2018 to $104 a month in 2022.

Over this time period the actual rates for drone insurance with SkyWatch didn’t change very much, which means that the shift in paying more has to do with choices drone pilots are making, not changing prices.

The main driver behind this trend is that drone specialists are becoming more professional every year. Drone pilots today have better drones, more sophisticated equipment and can do much more complicated operations. That means they have more expensive drones to insure, require wider coverage, and need higher liability.

– Eli Shalev, SkyWatch

Big picture, the upward trend in payment seems to show that drone pilots are valuing their drones more and more.

Here are a few more data points from SkyWatch to support this observation:

- The percentage of pilots who chose to insure their own drone (“hull damage”) is rising every year, and hit a high water mark of 34% of all policies in 2022.

- The average value of an insured drone has gone up more than 30% since 2018, from $2,997 in 2018 to $4,053 in 2022.

This data seems to bode well for the commercial drone industry, since it indicates that professional drone pilots value their equipment more each year, viewing it more and more as an investment worth making, and worth protecting.

Insuring Drone Equipment, Not Just Drones

Another indicator that drone pilots are leveling up their professionalism is that, more and more, they are insuring not just their drones, but also their equipment.

The DJI Zenmuse XT

In 2018, the percentage of SkyWatch clients that insured their drone equipment was 3.7%. Four years later, the number has grown to include 6.7% of commercial drone owners.

The drone-related equipment that drone pilots are insuring includes:

- Battery stations

- Ultra-bright screens

- Cameras

- Other drone-related gear